After using it myself for almost a week, I'm proud to announce version 0.2 is available for install (see Alright, I'm Ready To Share for original announcement).

Install Note Browser Filter

(click on this link in Google Chrome)

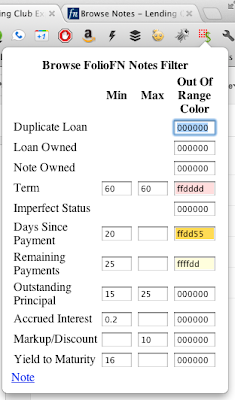

So let's start in with some of the changes. Next to the Out of Range Color boxes there is now a popup that allows you to choose from preselected colors, hide the matching Note or disable that filter altogether.

So let's start in with some of the changes. Next to the Out of Range Color boxes there is now a popup that allows you to choose from preselected colors, hide the matching Note or disable that filter altogether.I've found this handy when I want to temporarily disable a filter and then reenable it, specifically when I have change left over in my account, I don't expect to get 16% Yield to Maturity on $12 Notes.

You'll notice there are a few more links. These each open a section on this page. Opening the Preferences section allows you to set your Short Term Tax Rate (with a link off to a site where you can look it up), your Minimum Preferred Gain and the discount you want to give on Grace Period and Late Notes (in my experience all Late Notes are the same, hard to sell). Why would the extension need to know this information? Glad you asked.

You'll notice there are a few more links. These each open a section on this page. Opening the Preferences section allows you to set your Short Term Tax Rate (with a link off to a site where you can look it up), your Minimum Preferred Gain and the discount you want to give on Grace Period and Late Notes (in my experience all Late Notes are the same, hard to sell). Why would the extension need to know this information? Glad you asked.Now when you Sell or Reprice Notes, two new columns are added giving you the Annualized Return and the Markup. As you modify the values, those columns also update with the new values. The Annualized Return is based on the date you bought the Note (more about that later, see Caveat below) the Order Expiration Date (at the top of the table) the Asking Price, the Payments To Date, the Maintenance Fees, the Sell Fee and estimated Taxes (see Can Someone Check My Math? for details on the calculation).

As an example of what happens when you change the values, the snapshot of the table below is identical to the table above except I pressed the Principal + Interest button at the top of the table. Notice all the Markups went to zero and the returns were adjusted accordingly.

Another cool feature is that if any of the Asking Price fields are every empty (deleted) they will be filled in with the value that will give you your Minimum Preferred Gain from the Preferences. For the Sell Notes page, this will automatically fill in every Asking Price (since they start out blank) with a value that will give you your Minimum Preferred Gain (or Discount based on Grace Period or Late of the Note). When Repricing Notes, just delete the value in the Asking Price box and it will fill it back in with the appropriate value. This feature alone saves so much time. When you have 80 Notes you want to put up for sale, determining what you want the sales price to be and then entering it in can be mind numbing.

Caveat

In order for the Annualized Return (or the Asking Price) to be calculated, the extension has to "see" the purchase date on one of FolioFN's web pages. If you visit FolioFN's My Account and the Note shows up there as purchased (this month) then it will have seen the purchase date. However, if you purchased the Note in a previous month, you'll need to go to the bottom of the My Account page and look at the Trading Statement for the month that you purchased the Note and then change the Showing Notes to All.

All you have to do is view these pages after installing the extension. It will remember the purchase dates of all the Notes it sees. What I did to get things kicked off is open each Trading Statement in a new tab and then went to each tab and changed Showing Notes to All. Then I closed all the tabs. Do that once and the extension will remember all the purchase dates.

Feedback and Donate

I've added to other links, Feedback and Donate. The Donate link just gives an Amazon.com affiliate link you can use to show your support for the extension (or alternately PayPal information). I've spent all the time I really need to for my needs on this. I'll be using the donations as a gauge of how much time I'll spend adding requested features and improving the extension.

The Feedback link will send you back to this blog. For suggestions, problems, questions, etc. just leave comments on this blog.

I hope this helps make FolioFN a more usable part of the Lending Club experience (especially for those of us that FolioFN is the main part of Lending Club we can use). Let me know what you think.

.png)