(See Other Posts about Lending Club Extension)

Version 0.3 of the Lending Club Extension has been released (see what changed). I am getting feedback that we need more detailed information about how to use it.

(click on this link in Google Chrome)

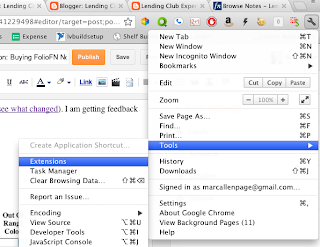

The first step is to click on the link above and go through the installation process (you may need to click a button at the bottom of this page saying you trust me, you do trust me don't you?). After you have installed the extension, you will see a Lending Club icon in your browser window. Clicking on this will bring up a settings window. If it feels a bit cramped, you can get a bigger page with the settings by clicking on the wrench (spanner) in the upper right corner (shown in the image here) and selecting Tools -> Extensions.

The first step is to click on the link above and go through the installation process (you may need to click a button at the bottom of this page saying you trust me, you do trust me don't you?). After you have installed the extension, you will see a Lending Club icon in your browser window. Clicking on this will bring up a settings window. If it feels a bit cramped, you can get a bigger page with the settings by clicking on the wrench (spanner) in the upper right corner (shown in the image here) and selecting Tools -> Extensions.  In the extensions list you'll see Lending Club FolioFN Note Filter (I need to change that name). The image below shows what it looks like (except it will be version 0.3 and it won't say (Unpacked)).

In the extensions list you'll see Lending Club FolioFN Note Filter (I need to change that name). The image below shows what it looks like (except it will be version 0.3 and it won't say (Unpacked)).

If you click the Options link you'll get the same options you would get by clicking the Lending Club icon at the top of the window, but you'll have more space to look at things like Help.

There are two main features that this extension helps you with, Buying Notes and Selling Notes.

Buying Notes (or Note Filters)

When buying Notes on the FolioFN platform, you'll see a table that looks something like the above. When the Lending Club extension is working, the table will have green rows (if not, there will be blue rows). There are some limited, though helpful, filters already available on FolioFN, seen in the box before the table. I usually choose the Never Late checkbox and uncheck the rest and leave everything else as is. Once you search with the FolioFN filters, then it's time to pull in the extension filters.

Clicking on the Lending Club icon at the top of the window will reveal a window with the extensions filters. They mostly match the column headers (and in the same order) as seen in the Browser Notes list above.

Some values have a Min/Max, for instance Days Since Payment. Let's say that you want Notes that are about to make a payment, but not so close that it is processing just yet. You would enter a Min of 18 and a Max of 24 (I've seen some Notes start processing 25 days after the last payment).

Any Notes that have Days Since Payment at 18 through 24 will be left untouched. If the Days Since Payment falls outside that range, the extension will look at the Out Of Range Color box to decide what to do.

Clicking on the popup menu next to the Out Of Range Color box for Days Since Payment will reveal options for actions to take. By default (empty box) the filter is disabled, meaning it will do nothing if it is outside the range. You can Hide Notes that are outside the range (you won't even see them). This will fill in the Out Of Range Color with six 0's (000000).

The rest of the options for Out Of Range Color are actually colors. These set the background to the selected color. The value that is filled in the Out Of Range Color box is of the format RRGGBB for the Red, Green and Blue value in web format (two digit hexadecimal values). Don't worry, you don't have to know what any of that means, you can just select from the menu the background color you want. The numbers and letters in the boxes are for those who want absolute control over the colors. Feel free to play around with them (6 characters either 0-9 or A-F).

Duplicate Loan

The second time (or more) a Loan Number is seen on a page, the Out Of Range Color will be applied. This helps prevent purchasing multiple Notes from the same Loan.

Loan Owned

If you own a Note from this Loan (either this Note or another Note) the Out Of Range Color will be applied. The is another help to prevent buying Notes from Loans you already own.

Note Owned

These are the Notes you actually own. Lending Club replaces the checkbox with a little blue circle so you can't select them anyway. If you select Hide Note (000000) for the Out Of Range Color then this noise will be removed from the table (you can't buy it anyway).

Imperfect Status

There are two statuses that are considered perfect, Current and Issued, anything else is considered Imperfect. This allows you to highlight or remove Notes that are In Grace Period or Late.

The selections above are what I use when I am hunting for Notes to buy. I remove all chances (well, nearly all) that I will buy two Notes from the same Loan (Duplicate Loan, Loan Owned, Note Owned). I don't care if Term is 36 or 60 months, so I leave that alone. I only want Perfect Status, so I hide all Imperfect Statuses. I don't want to buy Notes that are processing a payment, so I highlight in Light Red any Notes 25 days or more since the Last Payment (this helps filter out people selling Notes in Pre-Grace Period). I always want a Yield To Maturity of at least 16%.

What settings do you use? Are you having any problems or something is not quite clear? Have a suggestion to improve the extension? Leave a post below and I'll see what I can do.