First they ignore you, then they laugh at you, then they fight you, then you win.

Mohandas Gandhi

My parents visited us for Christmas. I owe a lot to my parents. From my father I learned the importance of temperance and striving for a spiritual life. From my mother I learned frugality and efficiency. With my father I often discuss politics and philosophy. With my mother I often discuss finances and investing. This particular visit, I mentioned that I was investing in Peer to Peer lending. The first thing she said was, "It's a pyramid. Get your money out while you can." This took me aback, but after thinking about it, I wasn't surprised. One of the common phrases I heard growing up was "never be the first on your block."

This leads me to Peter Renton's

No Google, Lending Club is Not a Scam post (sociallending.net). It got me to thinking. Why would someone search for "Is X a scam?" While pondering this idea, I read Seth Godin's

How much are you going to tip? post (sethgodin.typepad.com). This example he gave struck me:

There are two couples at the table, the waiter has brought separate checks and the credit card holder turns to the other credit card holder and tries to find out how to coordinate the tip.

Why?

I mean, if they were out just the two of them, would they ask what people at the other table were going to tip?

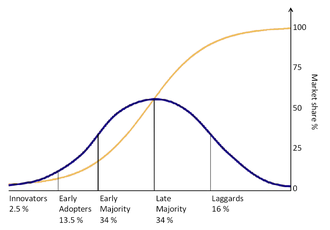

I've heard it said that all you need to have an opinion is a mouth. I guess the internet-age equivalent is, to have an opinion all you need is internet access. Searching (or is it googling) is an art. Using it for research on anything can be misleading at times, but especially for new and disruptive ideas. There is the idea of the S-Curve (see Wikipedia

Diffusion of Innovations).

The S-Curve is a visual representation of the Gandhi quote at the beginning of this post. A very small number of people in society adopt a new idea. At first no one pays attention to it. Then it starts growing from just the innovators to the early adopters. This is where people laugh at you, as Gandhi said.

Next as the early majority starts joining in, those who see it disrupting status quo start whisper campaigns against it, as well as those with ill intentions see an opportunity to make a quick buck. Somewhere between early adopters and early majority, the government usually steps in with regulations. They want to make it "safe" for everybody. If it can survive the whisper campaigns, the malintent opportunists and the regulations, then we get the late majority and finally the laggards. My parents advice to "never be the first on your block" places you firmly in the late majority to laggard stage.

There is nothing inherently bad about being a late majority or laggard. And most people are not 100% in any of these categories (I believe my parents were the first on their block to have Magic Jack phone service). Some people are laggards just because they were born too late (I am a TV and telephone laggard). Most people tend towards late majority and laggard as they age (things just change too quickly).

With investing, while there is risk in being an innovator or an early adopter, it is matched with a large reward. If you are investing before the early majority hits, you can benefit from the surge. For those who are constantly investing as innovators or early adopters, you understand that there is risk and you expect to lose sometimes.

There is only one way to learn, through experience. There is only one way to get experience, through mistakes. However, there are two types of mistakes, your own or someone else's. If you rely solely on your own mistakes, it will be a tiring, expensive and demoralizing experience. You will find the most success in using a balance of the two. Try to learn all you can and at the same time, take some action. Expect to make mistakes.

So back to the idea of a scam. There are two types of "scams." One is when the other intentions of the other party of to take as much of your money as possible without giving you equivalent value. The second, and more pervasive in internet "scam" searches, is when the other party has full intentions of giving you the stated value, but the person puts the blame of their lack of education behind the word scam.

So is Lending Club a scam? You'll probably find more and more in internet searches as Lending Club grows, and for them, they feel they were scammed. For those who educate themselves, learning from their mistakes and those of others, you'll know if it is a scam, or you will get some valuable experience.

(In my opinion, Lending Club is not a scam. I believe that they have full intentions of helping their customers receive as much benefit as they can from their investment. Oh, and for my mother, it is regulated by the Securities and Exchange Commission.)

For help in finding Notes in FolioFN or selling Notes before they mature, see

posts about Lending Club Extension.

(See other Monthly Status Updates)

(See other Monthly Status Updates)