(See other

Monthly Status Updates)

Already another month. My NAR keeps dropping like a rock as Lending Club is coming to terms with those Late Notes that will never pay as they move them to Default and Charge Off. I had almost a dozen Notes that went Late. One completely paid the Note off. One came back into payments (and then I was able to sell the Note). I think I sold another couple.

Even though the graph looks depressing, I am optimistic. I have realized what I have done wrong, and how to prevent future Late Notes (which nearly inevitably lead to Defaults and Charge Offs). Since the first wave I have only had one more Note go Late.

As I peruse the other P2P Lending Blogs (see several excellent ones to the right) it seems that 12% NAR is considered pretty good. It's definitely better than than the Stock Market (see

Why You Should Invest in the Stock Market) but my target is 16% or higher, mainly to offset the effects of real inflation (see

Not All Inflations Are Created Equal). I'm confident I can get back to 16%.

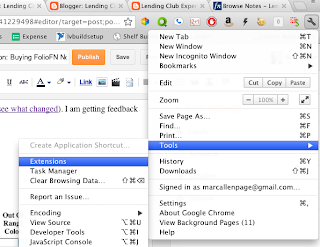

Once I learned the ropes of Lending Club, I wanted to make sure that the time I was spending on investing was not offsetting my gains (unless your time is worthless, you need to consider this). Now that I have the Chrome Browser extension (see

Alright, I'm Ready To Share), I feel like I have finally been able to bring down my time spent to a reasonable amount. Before I used this extension, I was only looking at Lending Club 3 days a week to cut down on the time I spent investing. Selling Notes used to be my biggest time consumption, and that was manually entering dozens (even more when I went to 3 days a week from 6) of sell prices from my spreadsheet. Now my extension enters them all for me (coming in version 0.2).

I'm back to 5 to 6 days a week, but it is a 5 minute checkup as opposed to 10 to 15 minutes. And the time spent will not grow dramatically as I scale up my portfolio. I was having a hard time seeing 400 let alone 800 Note portfolio before. Now I can easily see it.

I've now sold 3 times the number of Notes I currently hold (churn). My Notes held average $24.88 and I've held them on average for 2 1/2 months. The Notes I've sold I've held for just over 3 weeks. My median return on sold Notes is 28.8% annualized, or 38.2% days weighted annualized (the longer the Notes been held, the more weight it is given in the average).

The average rate for my Notes held is over 21%. This is a snapshot. I tend to sell off higher Interest Rate Notes, so my held Notes is a little lower, but we'll get to that later.

Almost all my Notes are 60 month Notes. I prefer it this way. I try to buy Notes with a lot of Principal left, which means that the payments are mainly Interest. 60 month Notes have even more Interest since the Principal is spread out over a longer period.

This is a natural side effect of how I choose Notes. I look for Notes with good Yields, and 60 beats out 36 just about every time.

Overall Composition

I always get concerned when I look at this chart. I really don't like holding G Grade Notes, but I have more G Grade than E Grade (I'd rather the reverse). I do like to see that the majority of my Notes are F Grade (in my opinion best Risk/Return balance).

The D and B Grade Notes are the stragglers when I have less than $25 left to invest, then I go find a good Yield Note with less Principal and these can often be lower Grade Notes.

The nice thing about having portfolios is that you can analyze your Note in different segments (see

How I Use Lending Club Portfolios). You'll recall I had separated out my fairly newly purchased Notes from those that I had received at least 2 payments from (my Buttercups and Wesleys, respectively). This helps me see how my buy and sell strategy plays out. I buy irrespective of the Note's information just on it's raw Yield or Discount. It could be a Note that has a plunging credit score, lives in Florida, leveraged to the hilt, only on the job for a month, high debt-to-income G Grade Note, and I'd still buy it because it has a good Yield to Maturity.

However, when I sell is when I look at the details of the Notes. That G Grade Note will get sold for near 16% annualized return markup. While the Notes I would rather keep, the F Grade 10+ year employed, home owner, from Oklahoma, get a higher, closer to 32% annualized return markup. So let's see how that affects my portfolios.

Buttercup

Buttercup

The Buttercup portfolio are the Notes I've recently purchased (and haven't gone bad in any way). As you can see, it skews highly towards the G Grade Notes. This is a symptom of buying Notes based solely on Yield To Maturity.

If you compare this graph to the overall composition graph, you'll notice that I sell many of the G Grade Notes before they reach a second payment.

Wesley

Wesley

My Wesley portfolio are the Notes that I've held for at least two payments and have not started missing payments. This is what I like to see in my portfolio. Overwhelmingly F Grade Notes, followed by E Grade and a few G Grade Notes (and a smackling of smaller Grade Notes).

Notice I still have an over 20% Weighted Average Rate, but I am more heavily invested in F Grade Notes, which have a lower Default Rate than G Grade, and have a higher average Yield (see

Low Risk, High Return Lending Club Strategy).

Strategy Change

I have three buying strategies I use. The first is Newly Issued High Yield to Maturity 60 Month Notes (see the bottom of

Seven Months In And Things Are Slowing Down). The second is High Yield to Maturity only. The third is Highly Discounted over 16% Yield to Maturity.

I used the second strategy the most heavily for the longest and have been using all three lately. However, until I get my extension to add risk factors to selling prices, I'm probably going to have to focus on the third strategy (Highly Discounted). Many of the seasoned veterans use this method (although not necessarily limiting it to above 16% Yield to Maturity) and have called into question the High Yield to Maturity model. Without my risk based selling prices, I think I'm going to have to agree with them. Plus Now I have a tool that allows my to visually see Discount vs. Yield to Maturity (see

Discounted Notes on Lending Club's FolioFN).

Conclusion

So the effects of the Late Notes from the end of last year are finally starting to show in my Net Annualized Return. We'll see when I actually hit bottom on that. As long as I can prevent future Late Notes (which eventually lead to Defaults and Charge Offs), which so far has been pretty successful and will only get better with the Chrome Browser extension, I think I can climb back up to 16%.

I'm excited about the time savings I am getting from using the Chrome Browser extension. It makes the process so much more fun (less tedious) and cuts my time spent "investing" dramatically. It cuts the time down so much, I feel like I still need to do something when I'm done, 5 minutes is not very long.

Well now, I was hoping to be further along before this post than I am. I intentionally (this time it really was) did not post last most. I considered it my quiet period as I was liquidating.

Well now, I was hoping to be further along before this post than I am. I intentionally (this time it really was) did not post last most. I considered it my quiet period as I was liquidating.

.png)