First they ignore you, then they laugh at you, then they fight you, then you win.

Mohandas Gandhi

My parents visited us for Christmas. I owe a lot to my parents. From my father I learned the importance of temperance and striving for a spiritual life. From my mother I learned frugality and efficiency. With my father I often discuss politics and philosophy. With my mother I often discuss finances and investing. This particular visit, I mentioned that I was investing in Peer to Peer lending. The first thing she said was, "It's a pyramid. Get your money out while you can." This took me aback, but after thinking about it, I wasn't surprised. One of the common phrases I heard growing up was "never be the first on your block."

This leads me to Peter Renton's No Google, Lending Club is Not a Scam post (sociallending.net). It got me to thinking. Why would someone search for "Is X a scam?" While pondering this idea, I read Seth Godin's How much are you going to tip? post (sethgodin.typepad.com). This example he gave struck me:

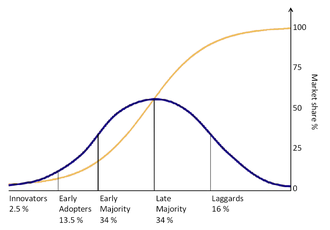

I've heard it said that all you need to have an opinion is a mouth. I guess the internet-age equivalent is, to have an opinion all you need is internet access. Searching (or is it googling) is an art. Using it for research on anything can be misleading at times, but especially for new and disruptive ideas. There is the idea of the S-Curve (see Wikipedia Diffusion of Innovations).There are two couples at the table, the waiter has brought separate checks and the credit card holder turns to the other credit card holder and tries to find out how to coordinate the tip.Why?I mean, if they were out just the two of them, would they ask what people at the other table were going to tip?

The S-Curve is a visual representation of the Gandhi quote at the beginning of this post. A very small number of people in society adopt a new idea. At first no one pays attention to it. Then it starts growing from just the innovators to the early adopters. This is where people laugh at you, as Gandhi said.

Next as the early majority starts joining in, those who see it disrupting status quo start whisper campaigns against it, as well as those with ill intentions see an opportunity to make a quick buck. Somewhere between early adopters and early majority, the government usually steps in with regulations. They want to make it "safe" for everybody. If it can survive the whisper campaigns, the malintent opportunists and the regulations, then we get the late majority and finally the laggards. My parents advice to "never be the first on your block" places you firmly in the late majority to laggard stage.

There is nothing inherently bad about being a late majority or laggard. And most people are not 100% in any of these categories (I believe my parents were the first on their block to have Magic Jack phone service). Some people are laggards just because they were born too late (I am a TV and telephone laggard). Most people tend towards late majority and laggard as they age (things just change too quickly).

With investing, while there is risk in being an innovator or an early adopter, it is matched with a large reward. If you are investing before the early majority hits, you can benefit from the surge. For those who are constantly investing as innovators or early adopters, you understand that there is risk and you expect to lose sometimes.

There is only one way to learn, through experience. There is only one way to get experience, through mistakes. However, there are two types of mistakes, your own or someone else's. If you rely solely on your own mistakes, it will be a tiring, expensive and demoralizing experience. You will find the most success in using a balance of the two. Try to learn all you can and at the same time, take some action. Expect to make mistakes.

So back to the idea of a scam. There are two types of "scams." One is when the other intentions of the other party of to take as much of your money as possible without giving you equivalent value. The second, and more pervasive in internet "scam" searches, is when the other party has full intentions of giving you the stated value, but the person puts the blame of their lack of education behind the word scam.

So is Lending Club a scam? You'll probably find more and more in internet searches as Lending Club grows, and for them, they feel they were scammed. For those who educate themselves, learning from their mistakes and those of others, you'll know if it is a scam, or you will get some valuable experience.

(In my opinion, Lending Club is not a scam. I believe that they have full intentions of helping their customers receive as much benefit as they can from their investment. Oh, and for my mother, it is regulated by the Securities and Exchange Commission.)

For help in finding Notes in FolioFN or selling Notes before they mature, see posts about Lending Club Extension.

Wow, this ended up being very disjointed. I was trying to put too much in, and editing it down really cut up the flow. It was about three times as long at first draft.

ReplyDeleteBasically,

1. googling for "scam" on anything is a bad idea, especially for disruptive technologies

2. before investing, do your homework, but don't wait forever, trying to get every piece of information, dip your toes in

3. there will always be people who have a poorly informed opinion, and those seem to be the most plentiful

For #3, let me clarify, the most plentiful before the late majority and laggards finally adopt.

ReplyDeleteLending Club itself is not a scam, but there are numerous scammers masquerading as borrowers there, as there are on any P2P site. Many borrowers file for bankruptcy shortly after receiving funds, sometimes without making a single payment. One P2P blogger wrote that he had been contacted by some borrowers who had declared bankruptcy (not pre-planned), and told him that LC hadn't put much effort into pursuing them. I don't think their collections process is very effective.

ReplyDelete@veggivet, I agree there are some people who try to scam P2P lending sites. As far as going after people who declare bankruptcy, P2P loans probably have the least pull in trying to recoup their money, and would spend more money trying to recoup than they could possibly get back. Bankruptcy is really considered a protection for the borrower against lenders.

ReplyDeleteThere are some things that protect P2P lenders:

1. Diversification. Smallest slice possible in a large number of *different* notes. (I've made the mistake of buying multiple notes from one loan and it went south)

2. Bankruptcy laws are more stringent. It is harder to go into bankruptcy. This does not stop the person who happens to meet the tougher requirements from taking advantage of the situation, but it does cut down on the number of people who can misuse the system.

3. Up front underwriting. Lending Club has stricter qualifications than Prosper (http://money-cake.com/2011/10/lending-club-vs-prosper-the-top-2-social-lenders/) which shows in the lower default rate of 3%(http://factoidz.com/lendingclub-review-and-promo-coupon-code/).

4. Education. There is only one way to learn, and that is through experience. There are two ways to get experience, yours and someone elses. However, the most effect is a combination of yours and someone elses. Read what you can then get started and try it out.

I try to share what I can what I have learned, as well as my results. That way people can determine if the risks are worth it. Out of over 500 notes I've held it looks like only 2% to 3% will go into charge off (only one note is actually in charge off, but I expect the rest to go into charge off soon)

Well, just for me, I make it a habit to google "X is a scam" or "x ripoff" to see if others are saying something bad, not necessarily because I have been hurt, just to see if others are thinking what I am or have been hurt.

ReplyDeleteSo maybe it can work out like unemployment numbers work out for the government. Since they don't count inactive workers in the pool ("Are you looking for work") those who answer no aren't counted as unemployed even if they need work. So, when the economy gets good again and people look for work, they will answer yes to that question, thus increasing unemployment numbers.

I've also noticed that some pages implying "X is a scam" or "X is not a scam" may have been put there by the companies or competitors. (kind of a supposition but sometimes their facts just sound like an ad).

Googling is lending club a scam is what got us to your page ;)

ReplyDeleteSpeaking for myself only, Googling "scam" with any "X" allows me to see if anything, bad or good, has come from others association with "X". Before the internet, contacting the BBB or personal experience of friends and neighbors was almost the only way of finding out about ad-mail offers that seem "to good to be true". Now the personal experiences of millions is available at a key stroke (or probably lots of key strokes). I have found, as the author alludes to, that most "scams" are reported by people who did not take the time to understand what they were getting for their dollar. There are legitimate scams out there. But, with some patience and a little time, it is easy to separate the wheat from the chaff.

ReplyDelete